W 4 Single Vs Married

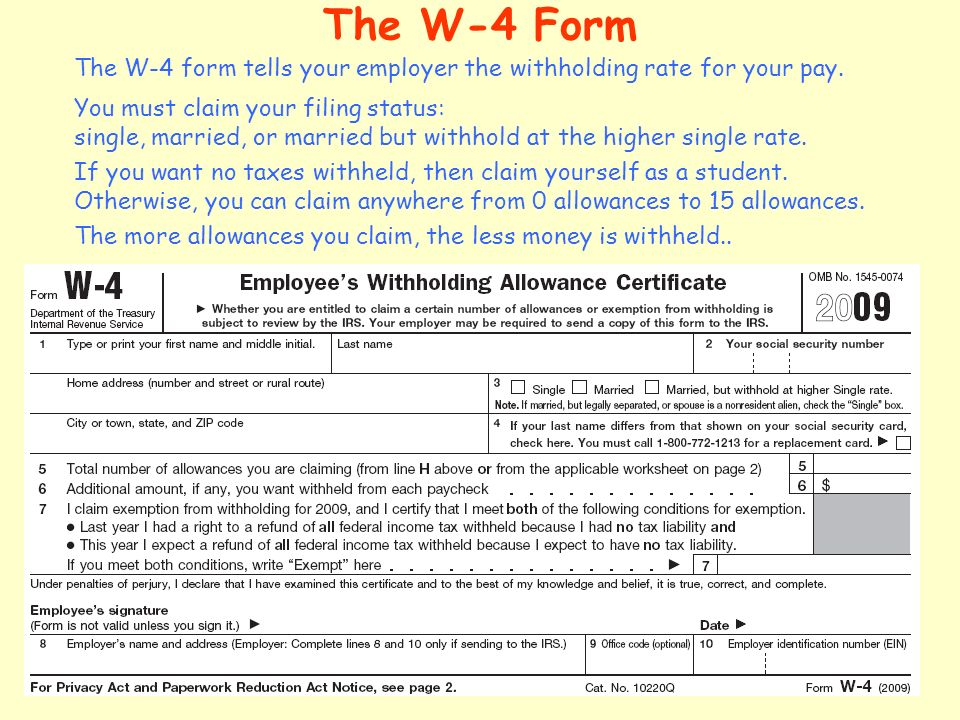

Feb 14, 2020 Filing joint typically provides married couples with the most tax breaks. Tax brackets for 2020 show that married couples filing jointly are only taxed 10% on their first $19,750 of taxable income. The W-4 form tells the employer the amount of tax to withhold from an employee's paycheck based on their marital status, number of allowances and dependents, and other factors. The W-4 is also.

- W 4 Single Vs Married

- W 4 Married Filing Single

- W-4 Withholding Single Vs Married

- Married 0 Versus Single 0

| Eisenstadt v. Baird | |

|---|---|

| Argued November 17–18, 1971 Decided March 22, 1972 | |

| Full case name | Thomas S. Eisenstadt, Sheriff of Suffolk County, Massachusetts v. William F. Baird |

| Citations | 405 U.S.438 (more) 92 S. Ct. 1029; 31 L. Ed. 2d 349; 1972 U.S. LEXIS 145 |

| Case history | |

| Prior | Habeas corpus petition dismissed, Baird v. Eisenstadt, 310 F. Supp.951 (D. Mass. 1970); reversed, 429 F.2d1398 (1st Cir. 1970). |

| Subsequent | None |

| Holding | |

| A Massachusetts law criminalizing the distribution of contraceptives to unmarried persons for the purpose of preventing pregnancy violated the right to equal protection. Judgment of the Court of Appeals for the First Circuit affirmed. | |

| Court membership | |

| |

| Case opinions | |

| Majority | Brennan, joined by Douglas, Stewart, Marshall |

| Concurrence | Douglas |

| Concurrence | White, joined by Blackmun |

| Dissent | Burger |

| Powell and Rehnquist took no part in the consideration or decision of the case. | |

| Laws applied | |

| U.S. Const. amends. IX, XIV | |

Eisenstadt v. Baird, 405 U.S. 438 (1972), was a landmark decision of the US Supreme Court that established the right of unmarriedpeople to possess contraception on the same basis as marriedcouples.

The Court struck down a Massachusetts law prohibiting the distribution of contraceptives to unmarried people for the purpose of preventing pregnancy, ruling that it violated the Equal Protection Clause of the Constitution.

Background[edit]

William Baird was charged with a felony for distributing contraceptive foams after lectures on birth control and population control at Boston University.[1][2] The prearranged violation of the law occurred on April 6, 1967 when Baird handed a condom and a package of contraceptive foam to a 19-year-old woman.[3] Under Massachusetts law on 'Crimes against chastity' (Chapter 272, section 21A), contraceptives could be distributed only by registered doctors or pharmacists, and only to married persons.

After Baird was convicted, an appeal resulted in partial overturn by the Massachusetts Supreme Judicial Court, which concluded that the lectures were covered by First Amendment protections. However, the court affirmed the conviction under contraceptive distribution laws. Baird filed a petition for a federal writ of habeas corpus, which was refused by the federal district court.[4] Upon appeal, The Court of Appeals for the First Circuitvacated the dismissal and remanded the action with directions to grant the writ, and dismiss the charge, reasoning that the Massachusetts law infringed on fundamental human rights of unmarried couples as guaranteed by the Due Process Clause of the Fourteenth Amendment.[5] This ruling was then appealed to the United States Supreme Court, by Sheriff Eisenstadt, who had prosecuted the case, on the ground that Baird lacked standing to appeal, being neither an authorized distributor under the statute nor a single person.

Supreme Court decision[edit]

In a 6–1 decision[6] (Justices Rehnquist and Powell were not sworn in in time to participate in the case), the Court upheld both Baird's standing to appeal and the First Circuit's decision on the basis of the Equal Protection Clause, but did not reach the Due Process issues. The majority opinion was written by Justice William J. Brennan Jr. and joined by three other justices, William O. Douglas, Potter Stewart, and Thurgood Marshall. Brennan reasoned that, since Massachusetts did not (and perhaps could not under Griswold v. Connecticut) enforce its law against married couples, the law worked irrational discrimination by denying the right to possess contraceptives by unmarried couples. He found that Massachusetts's law was not designed to protect public health and lacked a rational basis.

Brennan, writing for the Court, made four principal observations:

- Baird had standing to assert the rights of unmarried persons who wished to have access to contraceptives.

- Although states could constitutionally prohibit and punish sex outside of marriage, the Massachusetts law could not reasonably be held to advance that purpose, since a) fornication was a misdemeanor in Massachusetts, and a state could not reasonably wish to punish a misdemeanor by forcing an unwanted child on the fornicator; b) the state could not reasonably wish to punish the distributor of contraceptives as a felon for aiding and abetting the misdemeanor of fornication; c) the law did not prohibit the distribution of contraceptives to unmarried persons for the purpose of preventing sexually-transmitted diseases, and d) the law made no attempt to ensure that contraceptives legally obtained by a married person for the purpose of preventing pregnancy would not be used in an extramarital affair.

- The Massachusetts law could not reasonably be held to promote health, as whatever health risks posed by contraceptives were just as great for married persons as unmarried persons.

- The Massachusetts law could not be justified by the State's judgment that contraceptives are immoral per se, because the morality of contraceptives does not depend on the marital status of those who use it. It is possible that the Due Process right of privacy of married couples to use contraceptives recognized in Griswold v. Connecticut means that married couples have the right to have contraceptives distributed to them; if so, then unmarried people have that same right. ('If the right of privacy means anything, it is the right of the individual, married or single, to be free from unwarranted governmental intrusion into matters so fundamentally affecting a person as the decision whether to bear or beget a child.') But even if Griswold does not imply a Due Process right of married couples to be distributed contraceptives, the Equal Protection Clause prevents states from using the immorality of contraception as a basis for denying to unmarried people the same access to contraceptives as married people.

Justice Douglas, concurring, argued that since Baird was engaged in speech while distributing vaginal foam, his arrest was prohibited by the First Amendment.

Justice White, joined by Justice Blackmun, did not join Brennan's opinion but concurred in the judgment on narrower grounds. White and Blackmun declined to reach the issue of whether Massachusetts could limit distribution of contraceptives only to married couples. They argued that Massachusetts had asserted an implausible health rationale for limiting distribution of vaginal foam to licensed pharmacists or physicians.

Chief Justice Burger dissented alone, arguing that there were no conclusive findings available to the Court on the health risks of vaginal foam since that issue had not been presented to the lower courts, and thus no basis for the Court's finding that the Massachusetts statute served no public health interest. Burger also held that the Massachusetts statute independently advanced the state's interest in ensuring couples receive informed medical advice on contraceptives.

Significance[edit]

While Brennan's ruling conceded that states may prohibit sex outside of marriage, later cases have interpreted its most famous sentence—'If the right of privacy means anything, it is the right of the individual, married or single, to be free from unwarranted governmental intrusion into matters so fundamentally affecting a person as the decision whether to bear or beget a child.'—as recognizing the right of single people to procreate on the same basis as married couples, reasoning which would eventually be extended to a more general right to engage in sexual activity. Carey v. Population Services International, decided in 1977, struck down a New York law forbidding distribution of contraceptives to those under 16 but failed to produce a majority opinion and thus is not widely cited. Bowers v. Hardwick in 1986 rejected the claim of homosexuals to a fundamental right to engage in sodomy. However, Lawrence v. Texas overruled Bowers in 2003, citing Eisenstadt in support of this ruling, and recognized that consenting adults had a right to engage in private, consensual non-commercial sexual intercourse. Roy Lucas, a prominent abortion rights lawyer, assessed the case as 'among the most influential in the United States during the entire [20th] century by any manner or means of measurement.'[7]Eisenstadt v. Baird is mentioned in over 52 Supreme Court cases from 1972 through 2002.[7] Each of the eleven U.S. Court of Appeals Circuit, as well as the Federal Circuit, has cited Eisenstadt v. Baird as authority.[7] The highest courts of all 50 States, the District of Columbia, and Puerto Rico have cited Eisenstadt v. Baird.[7]

See also[edit]

References[edit]

- ^Eisenstadt v. Baird Summary

- ^Personal account of Plaintiff Bill Baird at prochoiceleague.org

- ^The Short History of Our Right to Contraceptives: Eisenstadt v. Baird 40 Years Later

- ^Baird v. Eisenstadt, 310 F. Supp. 951 (D. Mass. 1970).

- ^Baird v. Eisenstadt, 429 F.2d 1398 (1st Cir. 1970).

- ^Eisenstadt v. Baird, 405U.S.438 (1972).

- ^ abcdLucas, Roy (Fall 2003). 'New Historical Insights on the Curious Case of Baird v. Eisenstadt'. Roger Williams University Law Review. IX (1): 9.

External links[edit]

W 4 Single Vs Married

- Works related to Eisenstadt v. Baird at Wikisource

- Text of Eisenstadt v. Baird, 405U.S. 438 (1972) is available from: FindlawJustiaLibrary of Congress

W 4 Married Filing Single

The key difference between single and head of household is that for tax purposes, you can qualify as single if you’re single (unmarried, divorced, or, legally separated) whereas you can qualify as head of household if you are single, have a qualifying child or relative living with you, and pay more than half the costs of your home.

An IRS tax filing status is a classification that determines many details about a tax return. There are five filing status as single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. Single and head of household are two of this status for unmarried or single people.

CONTENTS

1. Overview and Key Difference

2. What Does Head of Household Mean

3. What Does Single Mean

4. Similarities Between Single and Head of Household

5. Side by Side Comparison – Single vs Head of Household in Tabular Form

6. Summary

What Does Head of Household Mean?

Head of Household is a tax filing status most people find confusing. However, it is very important to know about this filing status as it offers many benefits. This is a filing status for single or unmarried taxpayers who keep up a home for a ‘Qualifying Person’. To be more specific, you have to meet the following requirements to file as Head of Household.

- You are unmarried or considered unmarried until the last day of the year (this includes single, divorced, or separated people)

- You have paid more than half the cost of keeping up a home for the year.

- A ‘qualifying person’ lived with you at home for more than half the year, except for temporary absences.

A qualifying person is generally a dependent that lives with you. For example, an unmarried and unemployed daughter who lives with you can qualify as a ‘qualifying person’. You can use this link to determine whether the relatives who live with you are qualifying persons or not.

Furthermore, if you want to determine whether you have paid for more than half the cost of keeping up a home, the following are some of the expenses you have to take into account:

W-4 Withholding Single Vs Married

- Rent

- Mortgage interest

- Insurance payments

- Utility bills

- Food

- Property taxes

- Repairs and maintenance

- Other household expenses

If you meet the above requirements, you can apply as head of household. As mentioned above, this filing status has many benefits. The tax rate for this filing status is usually lower than the rates for single or married filing separately. Furthermore, this status also receives a higher standard deduction than single or married filing separately statuses.

What Does Single Mean?

Single is the filing status for unmarried people who do not qualify for Head of Household status. You can file your status as single if you were unmarried on the last day of the year, and do not qualify for any other filing status.

For tax purposes, a person’s marital status for the entire year is determined by his or her marital status at the end of the year, i.e., December 31st. If you are divorced or legally separated by December 31st, then you are considered to be unmarried for the whole year. However, if you are unmarried, but have a dependent child or a qualifying person, you can file status as Head of Household as it has several benefits over the single status.

What is the Similarity Between Single and Head of Household?

- Single and Head of Household are two IRS tax filing status for single people.

What is the Difference Between Single and Head of Household?

Single is an IRS tax filing status for unmarried people who do not qualify for another filing status. In contrast, Head of Household is an IRS tax filing status for single people who have a qualifying child or relative living with them, and pay more than half the costs of their home. These definitions explain the key difference between single and head of household.

Furthermore, the major difference between single and head of household is their requirements. Being single on the last day of the year, and not qualifying for any other filing status are the only two requirements for qualifying as single. But, qualifying as head of household has three main requirements: being unmarried or considered unmarried on the last day of the year, paying more than half the cost of keeping up a home for the year, and having a ‘qualifying person’ living at home for more than half the year. Furthermore, the head of household status has many benefits over single status. The tax rate for head of household is lower, and the standard deduction rate is higher when compared to single status. Thus, this is another important difference between single and head of household.

Summary – Single vs Head of Household

Single and Head of Household are two IRS tax filing status for single people. The key difference between single and head of household is that Single is a tax filing status for unmarried people who do not qualify for another filing status while Head of Household is an IRS tax filing status for single people who have a qualifying child or relative living with them, and pay more than half the costs of their home.

Married 0 Versus Single 0

Reference:

1. “Publication 501 (2017), Exemptions, Standard Deduction, and Filing Information.” Internal Revenue Service. Available here

2. “IRS Head of Household Filing Status.” Efile.com Taxes Made Simple. Available here

Image Courtesy:

1.”491626″ by stevepb (CC0) via pixabay

2.”16687016624″ by Pictures of Money(CC BY 2.0) via Flickr