Irs Loss From Sale Of Property

One property loss that won't create any tax benefit is the sale of your personal residence. You cannot deduct this loss from your taxes in any way. This is because the IRS does not tax the gains from selling a personal residence for a profit. To balance this out, taxpayers cannot deduct the loss of a personal residence sale from their taxes.

- Rental Property Sale Irs Forms

- Irs Loss On Sale Of Investment Property

- Irs Loss On Sale Of Personal Property

- Irs Sale Of Investment Property

The new European data protection law requires us to inform you of the following before you use our website:

Although you figure gain or loss on the easement in the same way as a sale of property, the gain or loss is treated as a gain or loss from a condemnation. See Gain or Loss From Condemnations, later. Property transferred to satisfy debt. A transfer of property to satisfy a debt is an ex- change. For tax purposes, a short sale is deemed consummated upon delivery of the property to cover the short sale. WASH SALE LOSS Requisites: 1) Sale of securities at a loss; and 2) Identical securities were purchased within a 61-day period, beginning 30 days before the sale, and ending 30 days after the sale. The tax code contains a simple rule to prevent this: You cannot deduct a loss on the sale or trade of property, if the transaction is directly or indirectly between you and a relative.

We use cookies and other technologies to customize your experience, perform analytics and deliver personalized advertising on our sites, apps and newsletters and across the Internet based on your interests. By clicking “I agree” below, you consent to the use by us and our third-party partners of cookies and data gathered from your use of our platforms. See our Privacy Policy and Third Party Partners to learn more about the use of data and your rights. You also agree to our Terms of Service.

Surely you didn’t buy your second property with the hope or expectation that it would decline in value. Real estate markets fluctuate, however, and the U.S. economy has not been kind to property investments in many parts of the country. After years of renting our your second property, perhaps you’re coming to realize that its value is significantly less than the purchase price. The good news is that you might be able to turn lemons into lemonade in the form of tax benefits.

Ordinary Income Tax vs. Capital Gains Tax

In case you don’t have much grounding in tax law, a few definitions will help you navigate the implications of your rental property sale. First, there are two broad categories of deductions to keep in mind: ordinary income tax deductions and capital gains tax deductions.

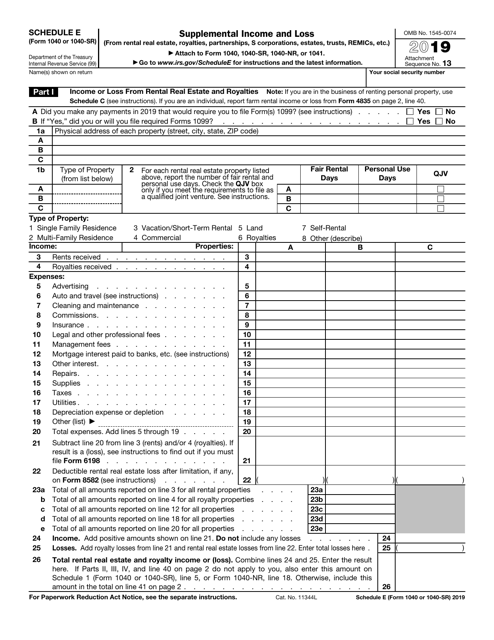

Ordinary income is, generally speaking, your wages and basic interest income – the main items that most taxpayers need to report on their IRS 1040 every April. Capital gains result from selling a capital asset, such as a stock, for more than its purchase price, or basis. Capital gains are taxed at lower rates than ordinary income, and are reported on Schedule D of the 1040.

Although profit on selling a rental property might have to be reported as capital gains, losses when selling rental property are deductible from your ordinary income. Learn more about the different types of taxable income on the Internal Revenue Service (IRS) website on “Capital Gains and Losses.”

Using Your Tax Basis to Calculate Your Loss

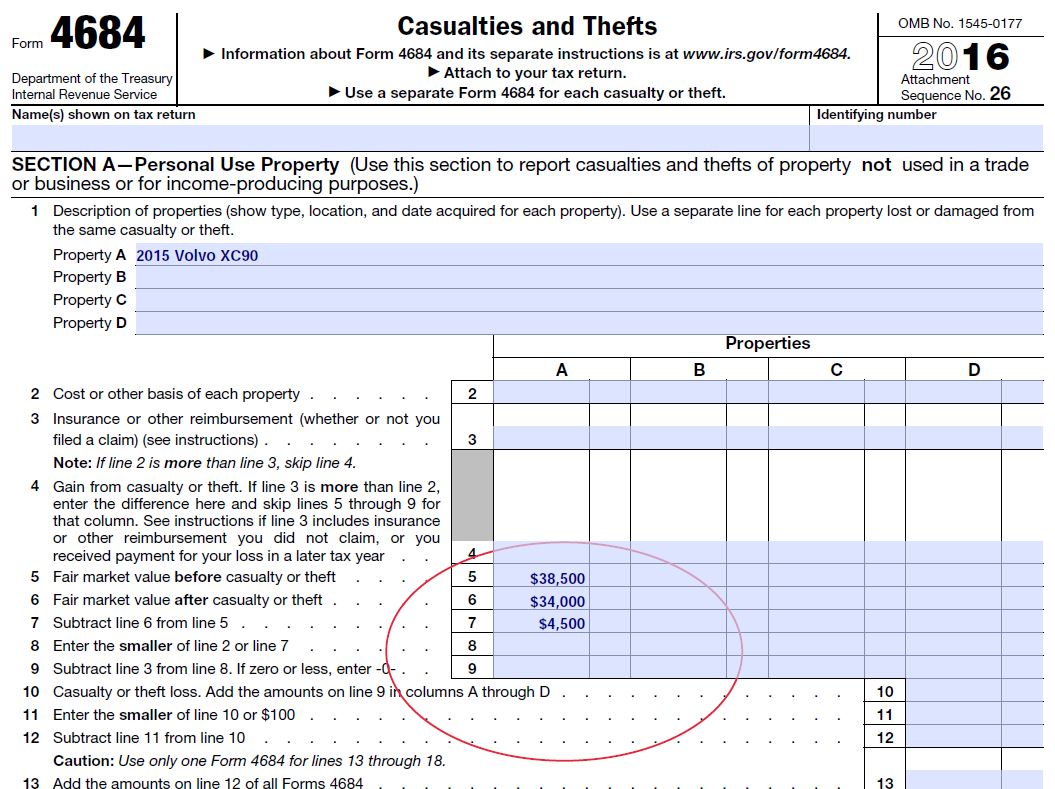

The first step in calculating your loss is figuring out your property’s “tax basis,” which you will later compare to your property’s sale price.

To determine your tax basis, add the amount you purchased your property for, plus any improvements (for example, renovations or additions, but not repairs) that you haven’t previously deducted from your taxes. These deductions include closing costs, such as legal fees and title insurance. Next, subtract any depreciation deductions that you’ve previously taken.

Rental Property Sale Irs Forms

As an example, let’s say you bought a property for $200,000 and made $10,000 in upgrades. This gives you a $210,000 tax basis. But you’re in a rough real estate market, and need to sell for $100,000 – a huge loss. In fact, when you subtract your tax basis from your sales price, you find that your loss totals $110,000, for tax purposes. That loss may be deductible.

No Deduction Allowed for Sale of Primary Residence

Importantly, the U.S. tax code does not allow deductions of losses for your residence, that is, the home you actually lived in – only for sale of investment-related property. As long as you’ve categorized your rental property as such, you should be able to take advantage of this benefit.

Converting Personal Residence to Rental Property for Purposes of Deducting Losses

Irs Loss On Sale Of Investment Property

Although you may think that you can get around the personal-residence rule (described above) by simply converting your home into a rental property before selling, this only works to a point. The U.S. government will not allow you to deduct losses in value from the time period before the rental conversion.

In other words, if you lived on the property before you officially began reporting it to the IRS as a “rental property,” and the house declined in value before the conversion, this might not be considered a tax loss. However, a loss from a decline in value after conversion to a rental is likely deductible.

Irs Loss On Sale Of Personal Property

Getting Professional Help May Be Worth the Cost

Irs Sale Of Investment Property

As you can appreciate, the nuances of these sales can be complex. Some are outlined on the IRS website on“Business or Rental Use of Home.” Make sure to consult an accountant or tax attorney and to figure out the tax basis of your property before you sell. This is a situation where “do it yourself” can be mostly if done incorrectly. The upfront cost of a professional consultation is far less than the risk of an audit of what will be a substantial sum of money.